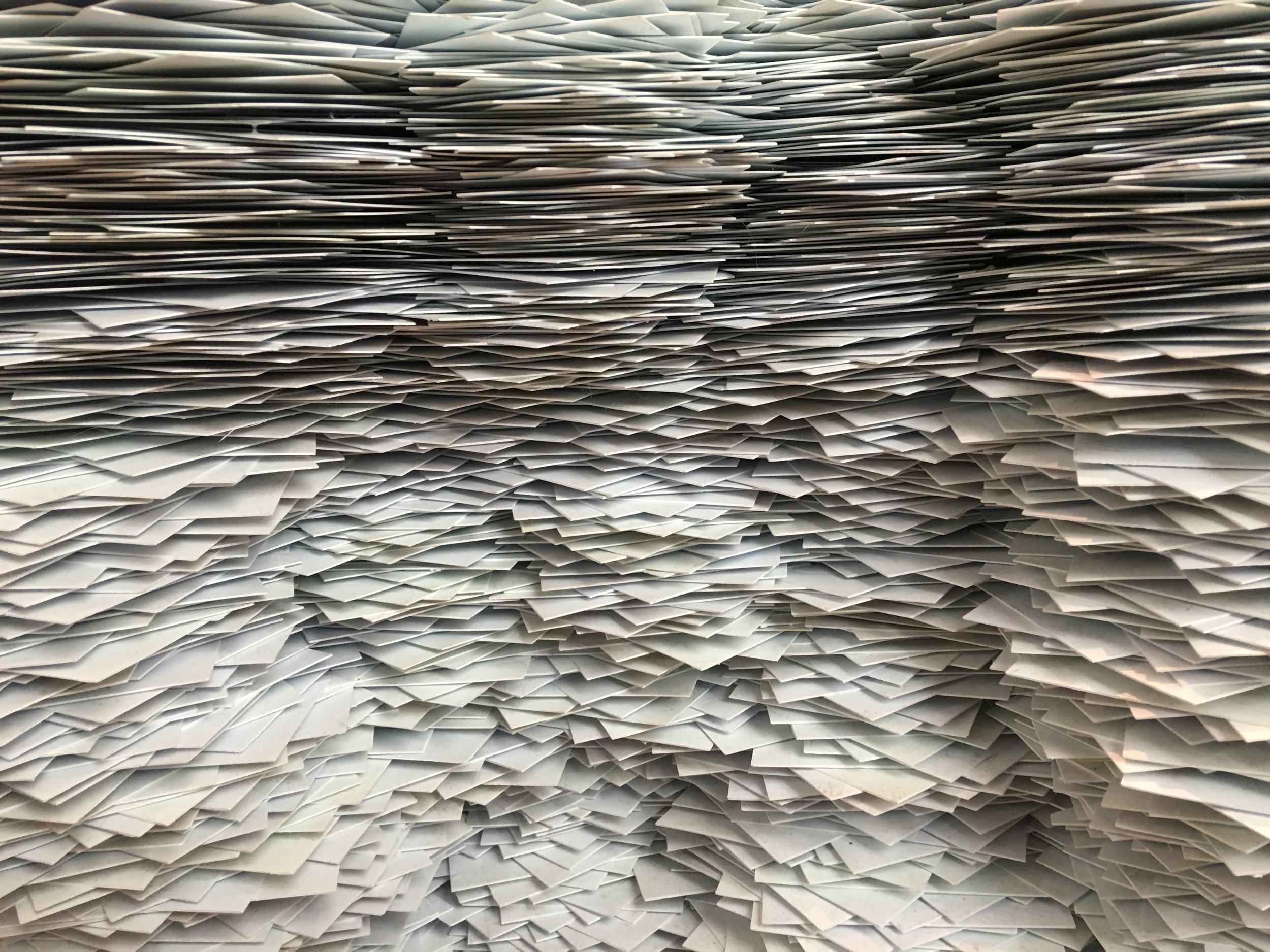

Don't Fear the Paperwork

We know what it’s like to be a business owner. You begin to get mail from the IRS, the Secretary of State, the Department of Taxation and Revenue, the Department of Labor, etc. It seems like everybody has something to say about how you are to run your business. Even federal agencies you thought had nothing to do with your business such as the Securities Commission, Federal Communications Commission, and the Environmental Protection Agency have a regulation you must follow. The truth is that your business does have legal obligations to these administrative bodies. What’s not true, however, is that you need to be afraid of working with them.

Next time you get letters in the mail from the government or your attorney, take a deep breath, get into a relaxed state of mind, and pretend it’s your friend writing to you about some preventive actions you can take to protect your business. And oftentimes, it’s true. The letters are reminders that you have an upcoming tax filing or annual business report that is due. Don’t ignore these letters.

To add to this, you should not be intimidated by the paperwork you are receiving from your attorney(s) either. Your attorney is your advocate. They are legally obligated to protect your interests. If you have any questions about the legal documents you receive, you should feel comfortable contacting your attorney to ask them your most basic questions. Most attorneys understand that not everyone is knowledgeable about the law. Ask your lawyer to explain everything to you.

If you need assistance responding to regulatory actions, work with a professional and timely respond to the notices and letters. The earlier you respond, the more money you will save.

Disclaimer: This article is provided for educational and informational purposes only. An attorney-client relationship is not formed by visiting this website, commenting on this post, or submitting information through the Contact Us form. The information provided here is not intended to, and should not replace, advice from a licensed attorney in your state. Kimberly Shin Law Firm PLLC disclaims all liability with regard to any and all actions taken or not taken as a result of information contained here.